In effect, this decreases the debt incurred over time. However, the trick is that those staked DAI stablecoins are used for yield farming by linking the mining pool to Yearn.Finance and other DeFi yield farming protocols. On its face, this would translate to just putting in dollars for dollars. In other words, for 2 DAI, you can borrow up to 1 alUSD – a synthetic derivative. This means that when you deposit DAI stablecoin as a collateral, you mint alUSD tokens in a 2:1 ratio. While ALCX is the protocol’s governance token, AlchemixFi tokenomics relies on Alchemix USD (alUSD) stablecoin, which is backed by a future yield. This little-known DeFi protocol has quite a novel approach to managing debt.

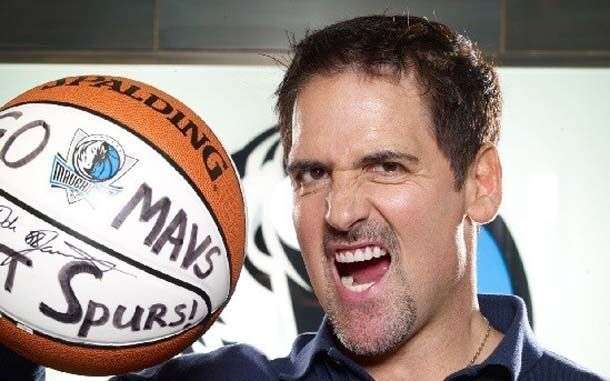

Pocket change for a billionaire, but pretty clear evidence he's a fan of /Y8wHSjNFJH- Bay May 16, 2021 Inevitably, this led to his wallet activities being tracked which leads us to the discovery that Cuban recently decided to swap 120 ETH ($402k) for AlchemixFi (ALCX) token. If you recall, courtesy of pseudonymous crypto researcher Dogetoshi, Cuban unintentionally revealed his Ethereum’s wallet address back in January, when he got excited by a new NFT find on the Rarible marketplace. After all, the Shark Tank co-host established his public persona by judging other people’s entrepreneurial prowess. Not to entangle another billionaire in the crypto space, it bears checking out what Mark Cuban has been up to in the DeFi space. Mark Cuban’s Wallet Bursting with DeFi Altcoins It owes this success by running on Ethereum’s Layer 2 sidechain, drastically decreasing transaction fees and massively increasing the influx of hungry yield farmers. Just during the last day or so, MATIC’s price rose by 30%.

On the other hand, MATIC is experiencing explosive growth projected to rise 5x by the end of the year. On the wind of smart contracts, Cardano (ADA) and Polygon (MATIC) soar and match each other in price (source: )Ĭardano’s (ADA) price rose due to its upcoming Alonzo upgrade, which will enable smart contracts. For instance, without even having implemented smart contracts yet, Cardano (ADA) matches Polygon’s (MATIC) price performance.

Mark cuban defi coins driver#

In fact, the combination of low transaction fees and yield farming gains remains a consistent driver for DeFi altcoins, impervious to Musk’s recent crypto sabotage. Demonstrating these widely different approaches to the crypto space, DeFi smart contracts hold almost two times the ETH than is present on centralized exchanges. While Bitcoin represents the first DeFi generation and hodling passivity, smart contracts entice greater engagement, exploration and experimentation. Although Bitcoin’s position as a sovereign, deflationary currency is not likely to significantly shift, smart contracts continue to bring value to the table on their own. With Musk’s weakened credibility as a pusher for a meme coin with infinite inflation, and myopically painting Bitcoin as a legitimate environmental concern, the crypto space can exhale a sigh of relief and move forward. In other words, hopping from one peak to the next was bound to land one in a valley. Although this represents a significant reduction from last week’s peek of $2.5 trillion, it bears keeping in mind that just a month ago it had reached a milestone of $2.25 trillion, matching the market cap of the world’s top 10 banks. Yet, it was becoming increasingly clear that Elon Musk represents a source of corrosive volatility, a centralization problem if you will.Īs a result of Musk’s leveraging of social media power, half a trillion has been cleaned out from the total crypto market cap.

After he joined Michael Saylor in buying $1.5 billion worth of BTC, the ongoing bullrun seemed endless. Except this time, the (self-proclaimed) ‘lord’ of the crypto space is the Dogefather himself, Elon Musk.ĭuring 2021, the Tokenist noted Elon Musk’s impact on the crypto space on multiple occasions. As the week starts with a crypto wipeout, many harken to these words of wisdom. Crypto Space to Leave Elon Musk in the Rear View Mirrorįans of religious texts and Western culture are familiar with the phrase contained in the King James Bible – “ The Lord giveth and the Lord taketh away”. In a much more positive and open light however, is Mark Cuban-a supporter of the technology, who appears too busy to troll twitter. The crypto space has been significantly affected by various influencers. Please consult our website policy prior to making financial decisions. Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Mark Cuban's Alleged Ethereum Wallet Suggests He Likes This Altcoin - The Tokenist Newsletter

0 kommentar(er)

0 kommentar(er)